South Hams Council want Government to close it.

To qualify for business rates, the property must be available for let for a minimum of 140 days per year, but by applying for Small Business Rate Relief, the charge is in most cases removed completely.

Cllr John Tucker, Leader of the Council, said: “It cannot be right that second home owners can let out their properties for hundreds of pounds a week, or even more, and pay absolutely nothing into the local economy. They are using local services and infrastructure like roads, and contributing nothing towards it.”

At a full council meeting in December, the council agreed to write to the Government urging them to consider the removal of 100 per cent Business Rate Relief on the letting of self-catering holiday homes as the current loophole has serious financial impact on local authorities with a high volume of Holiday Home Lettings.

Records show that there are 1,358 business rated properties in the South Hams which are second homes or holiday lets. If each property paid their fair share, an extra £2.47m would be available for South Hams District Council, Devon County Council and the Emergency Services. The share of this to South Hams District Council would be about £223,000.

Cllr Tucker added: “At a time when local authorities are struggling to maintain public services and our emergency services are under increasing pressures, the current system is fundamentally unfair. Small business rate relief was implemented to support our small businesses, village halls and local shops, not to allow people to dodge their responsibilities.”

In a letter sent to the Government, the council gave the example of how the loophole affects some of its parishes.

In Salcombe, because of a rise in the number of properties assessed as ‘Apartment Houses’, in this year’s Taxbase calculation, the taxbase has decreased from 1,974 to 1,930 (a 2.2 per cent reduction).

The 2018 Council Tax base for Salcombe has therefore reduced and resulted in a Council Tax increase for all remaining Council Tax payers of over two per cent (due to properties moving across to business rates), just to keep the Town Council spending the same and maintaining their precept at the same level as the previous year.

The letter also gave the example of East Portlemouth, a small parish with 153 homes, of which 60 are recorded on Council Tax records as second homes, with 25 properties are currently assessed for Business Rates.

It says: “Even a small number of second home owners taking advantage of the current system, or the proposed changes will make a massive difference on the tax base and local residents.”

The letter adds: “The Council Tax Base form submitted to the Government by the Council, showed that at October 2018, the Council had 3,835 second homes out of 44,338 properties in the District. This equates to just under nine per cent and means that one in every twelve homes in the District is a second home. The South Hams figures are more than seven times higher than the national average and therefore the issue in South Hams is one of the most acute in the country.

“In December 2017 the Council had 1,410 properties assessed as ‘Apartment House’ on the Business Rates system. In November 2018, this number had increased to 1,455. In the same period, the number of second homes registered for Council Tax reduced from 3,835 to 3,751. Of these properties, Business Rates of approximately £3.37 million is charged and £2.35 million in small Business Rates Relief is awarded.

“Should these properties be domestically banded (instead of being business rated), an estimated £2.47m more in Council Tax would be raised for the District (whose share would be around £223,000), Devon County and the Emergency Services.”

Cllr Tucker in the letter added: “South Hams District Council is firmly of the view that domestic properties should pay council tax on their properties, irrespective of whether they are let out or not. The banding of the property would be the responsibility of the Valuation Office Agency, and there would be no need for enforcement as the approach outlined would require.

“The council supports the District Council Network view that an alternative should be implemented, where self-catering accommodation is taxed solely through the council tax system, with legislation changed as necessary to deliver this.

“Should the Government not be open to change its approach, consideration should also be given to the ability for a Local Authority to be allowed to levy a Tourist Tax on these assessments that remain in the Business Rates system. This would assist the local community and economy where these properties are still allowed to avoid paying any form of local taxation.”

The Government is consulting on a number of proposals to ensure fairer funding for local authorities in the coming years, but councillors from across the board at South Hams District Council feel that the proposals do not go far enough and do not support the Government view.

14-year-old girl missing from Exeter

14-year-old girl missing from Exeter

Man reattaches flags moments after removal

Man reattaches flags moments after removal

Rocket builder careers in Cornwall to soar

Rocket builder careers in Cornwall to soar

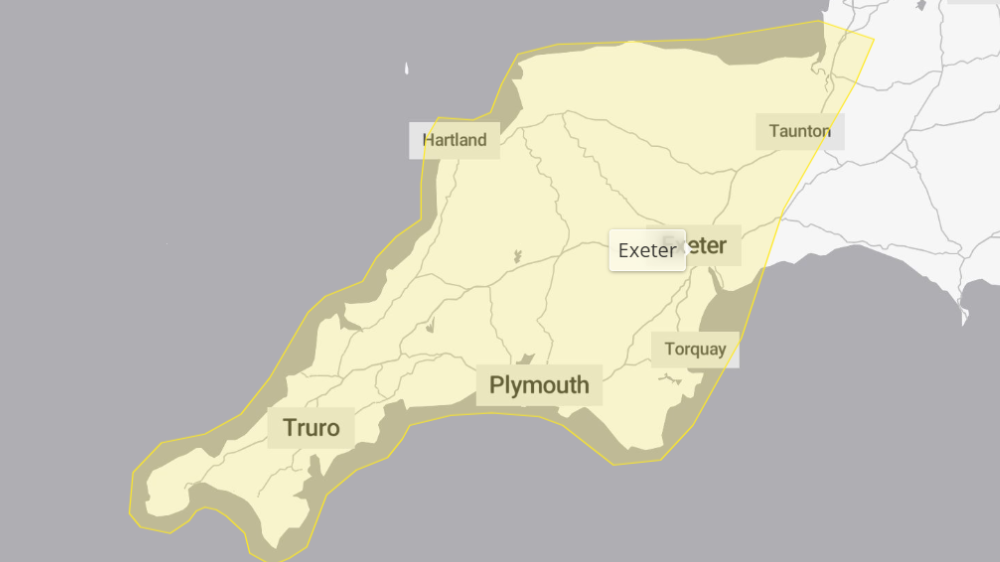

'Twas the weather warning before Christmas

'Twas the weather warning before Christmas

Police watchdog investigates after fatal Plymouth crash

Police watchdog investigates after fatal Plymouth crash

Torbay memorial bench prices top London's

Torbay memorial bench prices top London's